“The revenue of the state is the state.” Edmund Burke, Reflections on the French Revolution

Washington D. C. finds itself in the midst of an entertaining, nay consuming, Kabuki theatre. The federal government has “shut down” its non-essential functions, re-opened the same, and promised to do it all over again in a few weeks, raising the question as to why it has non-essential functions at all. Mr. Mueller’s fishing expedition continues sailing along through Mr. Trump’s tweet storms, as Democrats await the landing of the big tuna complete with waterside fish fry and impeachment. Meanwhile, the Trumpites patiently fantasize about their man turning the tables on the evil deep state by purging the temples and draining good ol’ foggy bottom. T’is all sound and fury underscoring Henry Kissinger’s view that the smaller the stakes, the more vicious the politics.

What is currently at stake is the survival of the last vestiges, really the tatters and shreds, of the old republic, and no one, neither leftists identity politics ideologues or MAGA hat wearing Trumpites are lifting even a whimper of protest, minus a few notable exceptions such as journalist Greg Hunter. What matters is 21 trillion dollars of unaccounted for spending. The story takes us back to the eve of the 9/11 attacks. Donald Rumsfeld, the Secretary of Defense, disclosed a particularly embarrassing piece of news that the Defense Department spent 2.3 trillion dollars and could not account for it. Conveniently for Rumsfeld and the DoD, some folks decided to pilot passenger jet liners into the World Trade Center’s twin towers, so the issue of the “missing money” fell to the wayside. Until, Catherine Austin Fitts, a former assistant Secretary of Housing during Daddy Bush’s reign, claimed that around 6 trillion dollars of spending could not be accounted for in the Department of Housing and Urban Development budget. One Dr. Mark Skidmore, a professor of economics and the holder of the Morris Chair of State and Local Government Finance and Policy at Michigan State University, was sure Fitts and her researchers were incorrect. So he and a team of graduate students combed through the publicly available financial records and found that Fitts was correct. So, just for kicks, they took a look at the spending records of the DoD and found another 15 trillion of unaccounted spending. As Skidmore and his intrepid team dug deeper into the bowels of federal agencies with information requests, the Office of the Inspector General pulled the plug on all the internet links to the key documents that showed the unaccounted for spending. Eventually the links came back up, and with a promise of an audit of spending by the DoD. Clearly, Dr. Skidmore had hit a nerve.

Various and sundry debunkers have gone into overdrive to assure us that all is well. The leading court newspaper, the Washington Post, is quite certain that this is a case of double counting or perhaps lost receipts. Other sober minded folks have compared this to someone forgetting about the twenty-five bucks you paid an enterprising teenager to mow your lawn, or perhaps it’s like when you forget to report a meal on your expense account, or you double booked the latte at Starbucks. A few lawns, some lattes, some double booked F-35s, some uncounted $300.00 toilet seats and pretty soon we have 21 trillion dollars of unaccounted spending. The Post never produced any evidence of plugging or double booking of accounts, bless their hearts, they just took the federal government at its word.

But we really can’t take the federal government at its word. Consider Federal Accounting Standards Advisory Board (FASAB) Statement 56. According to Michele Ferri and Jonathan Luire, Statement 56 is fraught with perils for the republic.

In the absolute most simple terms, Standard 56 allows federal entities to shift amounts from line item to line item and sometimes even omit spending altogether when reporting their financials in order to avoid the potential of revealing classified information.1 However, as with all laws, nearly every word in that sentence is a complicated concept to unpack. Who counts as a federal reporting entity? When and how can these entities conceal or remove financial information from their reports? What information can be removed? When does something count as confidential, and who makes that determination? . . .

The simplest place to start with understanding Standard 56 is its scope. It applies to federal entities that issue unclassified general purpose federal financial reports (GPFFR), including where one entity is consolidated with another. This means it only applies to otherwise unclassified financial reports where there is a risk of revealing classified information; classified financial reports are their own can of worms. (see generally FASAB Statement of Federal Financial Accounting Standards 56, available at http://files.fasab.gov/pdffiles/handbook_sffas_56.pdf) Standard 56 also doesn’t remove the actual requirement to report, it just allows these entities to change their reports in ways that don’t reflect their actual spending.

Simply put, a broad interpretation of Statement 56 (When has the federal government not chosen the broad interpretation?), books can be cooked if an entity, public or private, is spending money or fiscally involved in operations that are related to national security. This renders the balance sheets and accounts of both the federal government, and the corporations that do business with the government, deeply suspect at best, completely untrustworthy at worst. Most ominous, it effectively removes public spending from any meaningful oversight by the people or the representatives of the people and the states in the Congress. What is in place now is the legal architecture to support legitimize financial fraud.

We the People should be outraged, but we are not. Though the federal government spends the vast amount of its time on fiscal matters, and it always has, We the People find such matter boring and confusing. The mandarins and despots of banking and finance have purposely obscured their machinations behind a fog of technical jargon, just as the government does the same under the veil of national security. One has to dig and learn, and let’s face it, watching the Donald and his assorted nemeses is way more fun. If you prefer your entertainment served up with identity politics hypocrisy, then joining the media’s verbal assault on the young men from Catholic Covington might be your thing. Our people’s distraction from mundane fiscal matters, and their growing cynicism and detachment from significant public affairs, does nothing to lessen the real danger of this hideous consolidation of political and economic power under the cover of legitimized fiscal fraud.

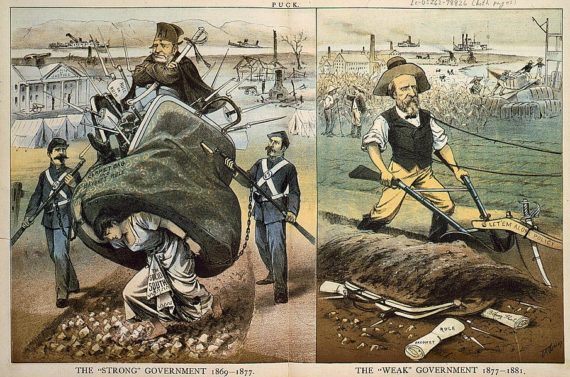

Long ago, Patrick Henry warned the state convention of Virginia to reject the proposed federal Constitution, for there was “poison under its wings.” Once the constitution was ratified, Alexander Hamilton did all in is power to make sure that the poison be given as a free a reign as possible through the body politic. Henry had in mind the terrible prospect of the consolidation of central power at the expense of both the states and the people. Hamilton had in mind the consolidation of political and financial power via a marriage of a powerful and centralized government with crony capitalists. Hamilton’s public persona argued this was necessary for the federal government to have access to credit in times of national emergency. Privately, he and his ilk hoped to profit handsomely from the perpetual public debt, the country’s “public blessing.” One need only witness the financialization of all assets, the monopoly over the currency exercised by the Federal Reserve Bank–owned lock stock and barrel by the large investment banks, the minotaur’s maze of unelected bureaucrats known as the deep state, and regulatory capture at all levels of government. What we have today is so egregious it might even shame Hamilton, in whatever infernal region he now resides. And make no mistakes, Democrats and Republicans, progressives and liberals, neo-conservatives and “conservatives” have all taken a hand in constructing this hideous edifice.

For those who look to the Constitution for redress, we can only offer our pity. The paper barriers, especially vigorously enforced ninth and tenth amendments, were emasculated long ago. The last redress is the second amendment, and ever do the enemies of liberty wish to rid themselves of this last restraint on government power. No, the statists and consolidationists have general welfare claused, commerce claused, and necessary and proper claused most of the paper barriers into oblivion. Certainly we must encourage and carefully tend any sprouts of hope: nullification, secession, any assertion of state authority. Remember too our first constitution of perpetual union, the Articles of Confederation; it is not too late to dust it off, add a fiver percent ad valorem duty to pay for a navy, and call it a day. But have no delusions, as long as revenue is sent to Washington D.C., as long as the Hamiltonian architecture remains in its hypertrophied form, as long as fiscal fraud is openly legitimized, there is little that can be done to withstand the assaults from the combined forces of the statists and the crony capitalists. As the Arctic vortexes descend upon us, build a warm fire, pour a beverage of your choice, take down and read John Taylor of Caroline’s An Inquiry and Tyranny Unmasked, and know who and what we must combat.