A review of For Good and Evil: The Impact of Taxes on the Course of Civilization by Charles Adams (Madison Books, 2001).

Why can’t American Presidents learn that if you raise taxes on the American people they will vote you out? George Bush crashed because he raised taxes, and Bill Clinton will go down as soon as the people get a shot at him. Maybe the people are awful to react to taxes in such a negative way, but the fact remains that the political consequences of raising taxes today is death.

It was not always like this. Americans pay their taxes when they support the government’s policies. They did in World War II. Irving Berlin wrote, “You see those bombers in the sky / Rockefeller helped to build them / so did I.” If, however, the government, like George III, is pursuing programs the people don’t believe in, taxation may lead to a revolution.

The problem today is that the democratic bond between the people and their elected representatives has snapped. If that proposition seems a little extreme to you, try to remember the last time Congress passed a law that you liked. You have to go back a long way. The people, by tax resistance, are saying: if you won’t listen to us on the things that are important to us, the things that determine what kind of society we live in, e.g. affirmative action, criminal justice, pornography and schools, we will do what we can to cut your money off. Even a failed government can probably float along if it asks little or nothing from the people. Maybe a 4.3 cents a gallon gas tax is o.k., but maybe 10 cents a gallon is not. At some point, though, a little wind is going to turn the boat over.

Bill Clinton, in his August 3, 1993 oval office address said we had to “assume responsibility for ourselves, our communities and our country. No more something for nothing. We’re all in this together.” We are, he said, “on the eve of historic action.” The President, who during the campaign had promised a middle class tax cut, went to great pains to say he was not asking for sacrifices from the middle class: “80 percent of the new tax burden fall on those making more than $200,000 a year.” The plan, he explained, was fair it asked the “average working family to pay no more than $3 a month in new taxes, less than a dime a day.” The President said over and over that he was just raising income taxes on the top 1.2 percent of families.

The middle class, however, didn’t believe it. Polling taken after the talk asked: “Who will pay the most under the President’s plan?” Only 22% thought the “wealthy” would pay the most while 68% thought the “middle class” would. Forty-four percent of the people said the President’s plan asked for “too much sacrifice.” Forty-four percent of Americans, therefore, take the position that “less than a dime a day” is too much sacrifice to accomplish what the President called “historic action.” What, exactly, is going on? The White House believes, because of Republican disinformation, the public does not understand the plan. They would like it if they understood it. But the middle class understands it well enough; it just doesn’t believe the promises that the new taxes will fall somewhere else. They have been deceived and fooled so many times. Any tax bill, they believe, is going to soak the middle class because that’s where the money is. Only 33% of the people supported the President’s plan. Congress, undismayed, passed the new taxes.

The middle class suspicion that some hidden provision will get them is based on long experience. This time, the administration, in a bold move, has called the hidden middle class tax hike a “cut.” The proposed $56 billion in Medicare “cuts” are in fact, disguised tax raises. The trick is that the Budget Bill reduces reimbursement for doctors and hospitals who then make up the loss by raising fees on non-Medicare, mostly middle class patients.

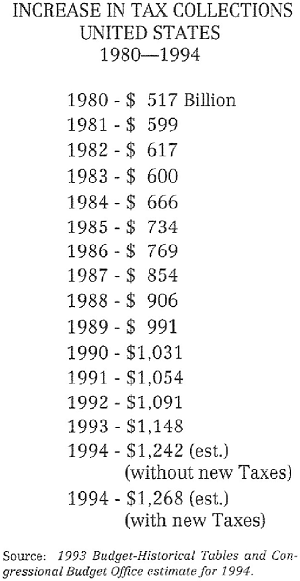

The government, even before the new taxes, is asking for a great deal of sacrifice. Americans currently pay $4,660 per head in Federal tax. Not surprisingly, the polling reports that Americans believe they are heavily over-taxed. How, in a democracy, can we be taxed more heavily than we want to be? That seems like a reasonable question, particularly in view of the following chart:

Does history help explain how a democracy can be more heavily taxed than it wants to be? Charles Adams’ new book, For Good and Evil-The Impact of Taxes Upon the Course of Civilization, examines the role of taxation in history. Mr. Adams is a practicing tax lawyer and brings a practical view to his fascinating study of taxes. As he notes, behind every political event, if you dig deep enough, there is a financial or tax explanation. He believes: “Taxes are the fuel that makes civilization run, but how we tax and spend determines to a large extent whether we are prosperous or poor, free or enslaved, and most importantly, good or evil.” Taxes, in short, are the heart of the relationship between the people and government. His central thesis is that declined cultures have had bad tax systems. Rome, for example, rose to greatness under a liberal tax regime but declined under high oppressive taxes. A government or empire can’t tax too heavily and survive. People getting mad about taxes is a major force for shaping history.

Some of Adams’ story is familiar (English Constitutional History) and some controversial (American Civil War). King John was chronically short of money. The customary feudal taxes did not bring in enough money for the King, so he designed some creative new taxes to meet his needs. The barons refused to pay and met him on the plains at Runnymede in 1215 and made him promise to stop. The key provision of the Magna Carta was: “No scutage or aid, save the customary feudal ones, shall be levied except by the common consent of the realm.” The consent of the governed, in this case, meant the consent of the barons, but a great idea was born that would end up as the premise of Jefferson’s Declaration of Independence. Adams makes the interesting point that the courts construed the language “common consent” to mean that no baron was bound unless he, individually, consented. Let Congress try that one.

In the seventeenth century, following the English Civil War and the beheading of Charles I, the Parliament definitively took over the power to tax and spend. The Bill of Rights of 1689 established that there would be no taxation except by act of Parliament. For Englishmen, as Adams points out, the issue of taxation and consent was finally settled after a 500 year struggle. John Locke, in 1690, wrote:

Thirdly, the supreme power cannot take from any man any part of his property: without his own consent. For the preservation of property being the end of government, and that for which men enter into society…. It is true governments cannot be supported without great charge, and it is fit everyone who enjoys his share of the protection should pay out of his estate his proportion for the maintenance of it. But still it must be with his own consent. . . For what property have I in that which another may by right take when he pleases himself?

The American colonies, however, were not represented in Parliament and were consequently taxed without representation. Adams points out that the taxes the Crown imposed on the colonies were not oppressively large. The British taxes were modest, and the money was to be spent in the colonies for their benefit and protection. The 1764 Sugar Act was the Crown’s first and only successful tax in the colonies. The Stamp Act and Town-shend duties produced little revenue for the Crown, yet were bitterly opposed. The Crown, like Bill Clinton, thought its taxes were fair, the equivalent of “less than a dime a day,” and could not understand why the Americans were so unreasonable. Adams notes: “If revolution is the consequence of oppression, then the American Revolution should never have occurred.” Adams believes the Revolution was based on our objection to the lack of consent.

A revolution, however, is not necessarily the consequence of oppression, and people don’t go to war because of a theoretical lack of consent. A revolution is a conflict between incompatible conceptions of what the community ought to be. The colonists believed in individual liberty as Jefferson expressed it in the Declaration of Independence. Princeton Professor R.R. Palmer, in the Age of Democratic Revolution, writes that a “revolutionary situation” is one in which

confidence in the justice or reasonableness of existing authority’ is undermined; where old loyalties fade, obligations are felt as impositions, law seems arbitrary… The crisis, at this point, is a crisis of the community itself, political, economic, sociological, personal, psychological and moral at the same time. . . Something must happen if continuing deterioration is to be avoided; some new kind or basis of community must be formed.

In a revolutionary situation, less than a dime a day is too much.

Madison and the founding fathers, Adams writes, imposed specific constitutional controls on the taxing power beyond the general requirement of “consent” by taxpayers through their representatives. Taxes had to be “uniform throughout the United States.” Direct taxes had to be apportioned among the states according to population. The federal taxes were intentionally difficult to impose. Basically, the founders believed the federal government should finance itself out of customs.

Adams, in one of the book’s best chapters, discusses Enlightenment ideas about taxes. The Enlightenment wisdom, Adams writes, was built on the violence and the strife of the seventeenth century. Bad taxes caused civil war in England, the collapse of the Spanish Empire, the decline of the Netherlands. France was worst of all, with its paramilitary tax police to enforce collection and the bloody suppression of numerous tax revolts.

Locke, Montesquieu, and Adam Smith considered the relation of taxes to despotism and to prosperity. Montesquieu, in his The Spirit of Laws (1751) wrote:

The revenues of the state are a portion that each subject gives of his property in order to secure or to have the agreeable enjoyment of the remainder.

To fix these revenues in a proper manner, regard should be had both to the necessities of the state and those of the subject. The real wants of the people ought never to give way to the imaginary wants of the state.

Imaginary wants are those which flow from the passions, and from the weakness of the governors, from the charms of an extraordinary project, from the distempered desire of vain glory and from a certain impotency of mind incapable of withstanding the attacks of fancy. Often has it happened that ministers of a restless disposition, have imagined that the wants of the state were those of their own little and ignoble souls.

Montesquieu also wrote that liberty carries the seeds of its own destruction: “Liberty produces excessive taxes: the effect of excessive taxes is slavery.”

Adams entitles his American Civil War Chapter: “Was it Taxes, Rather than Slavery, That Caused the Civil War?” Adams argues that, following the Dred Scott Decision (1857), the Southern states “were undoubtedly the victors in their struggle to preserve the slave system of America.” Therefore, there “had to be something else that caused them to fire the first shot.” The “something else,” he believes, was the North’s high tariff policies. Because of high tariffs, Southerners had to pay either excessive prices for Northern goods or buy the foreign goods and pay the tariff on them: “Federal taxation had the economic effect of shifting wealth from the South to the North.” Prior to 1832 the tariff was justified to fund the payment of the national debt. But after Jackson paid the debt off, the Southerners thought the tariff should come off too. The South called the Tariff of 1832 the “tariff of abomination.” The North, by continuing the tariff, was exacting tribute from the South. In 1861 Lincoln signed the Morrill Tariff which doubled existing rates. The South, in Adams’ view, had no choice.

Adams’ Civil War theory is a bit overstated. Neither the South nor the New England abolitionists thought the slavery issue was settled. But nevertheless, Adams is correct in asserting that at some point and in some manner, the economic differences between the regions had to be resolved. The Republican party was based on an overarching vision—the creation of The American Market—a trade zone of unprecedented size and resources. The Republicans were willing to maintain that zone by force to prevent the free-trade South from attaching itself to the economy of Europe.

In America the tax issue is being played out against the background of the economic and political failure of the middle class since 1972. The middle class is unable and unwilling to carry the taxes they are carrying much less the new ones the Clinton administration has in mind. The middle class is in no mood for sacrifice or contribution. Even “less than a dime a day” is too much to preserve a government that is a war with its people.

The people and the government have incompatible conceptions of what the community ought to be incompatible conceptions of the nature of man and his relation to the world. The government, for 25 years, has pursued a version of European “cradle to grave” social democracy. The individual, to this philosophy, is the enemy of the group. The Clinton conception, what it calls the “politics of meaning,” believes that individualism leads to alienation. Mrs. Clinton, in April, said that “economic growth and prosperity, political democracy and freedom are not enough.” She aspires to a secular utopia, “the sense that our lives are part of some greater effort, that we are connected to one another,” that “we are part of something bigger than ourselves.”

The majority of Americans, on the other hand, are Jeffersonian; they believe in the value of the individual, individual liberty, less government, and less taxes. To the majority, economic prosperity, political democracy, and freedom are enough. The country has to decide if it is going to follow the people’s ideas or the government’s ideas. It can’t follow both. Something must happen if continuing deterioration is to be avoided; some new kind or basis of community must be formed.

Mr. Adams believes the central ideas of the Enlightenment—moderate government and moderate taxation—have been submerged by the modern welfare state. He believes the most challenging problem of our age is whether or not civilization can extricate itself from its own tax self-destructiveness. Whether we can avoid Montesquieu’s prediction that liberty carries the seeds of its own destruction, the reader will enjoy Mr. Adams’ thoughtful book.

This review was originally printed in the 4th quarter 1993 issue of Southern Partisan.