Part One: Definitions and Origins

Money is a great mystery. In my years of teaching economics courses and economic history nothing so confuses students, and their elders, as the subject of money. Or rather I should say the subject of money and currency. Some of this confusion is a result of the failure of economists to agree on standard definitions of money and currency, and thus the two are often confused and conflated in standard works on the subjects as well as by the “talking heads” on financial shows. The failure to nail these definitions down leads everyone to talk past each other. So without further ado, let us begin with definitions.

Money is an abstract concept whereby certain characteristics and functions are attached to an object, but these characteristics and functions may not be exclusive to a particular object. So in defining money, we need to focus first upon these vital characteristics and functions. Something is money if it has all of the following characteristics: a store of value, portability, divisibility, and acceptance as a medium of exchange. Let us have a closer look at each of these. Something becomes a store of value when we are convinced that the object will maintain its utility for future purchases. Thus we “save” the object. Some economists refer to this as the asset demand for money, or view money in this function as a type of energy that is stored for future use. It is all the same, we collect and save money because we believe it will hold the value it has today into the future as well. When it comes time to use money for investment or purchases, it is most convenient to be able to carry it around, and to be able to divide it, that is to make change. Finally, we hope that sellers will accept our money as a medium of exchange in payment for goods and services; it makes for a much more pleasant evening if we can pay with money an owner of a café for a meal rather than do dishes all night. In general, gold and silver have best performed the functions of money, but other things can and have been used as money in the past: tobacco, cigarettes, sea shells, etc.

Currency is a bit different. Currency also needs to be portable, divisible, and acceptable as a medium of exchange, but its utility as a store of value depends upon the ability of the issuer of the currency to exchange currency for money when called upon to do so. For you see, currency is an IOU, a promise to pay, a note. Pull out a dollar bill from your wallet or purse. At the top you will read the words, “Federal Reserve Note.” You are holding in your hand currency, a promise from the Federal Reserve Bank to pay you one dollar, more on that in a moment. Otherwise, the value a currency has is tied to its acceptance as a medium of exchange in the short run, for you see dear reader, paper currencies do not last, they go the way of all flesh. By the way, a dollar was once upon a time defined as a coin containing 371.25 grains of fine silver. Today, a “dollar” is little more than a unit of account. That IOU, the federal reserve note in your hand, is an IOU nothing. Back in the day, such a note had to be redeemed in either silver or gold. Today, it is the mere acceptance of the note as currency (i.e. a medium of exchange) which gives it any value at all. As a store of value, the federal reserve note has had a pathetic track record. Since its introduction in 1916 it has lost more than 90% of its purchasing power.

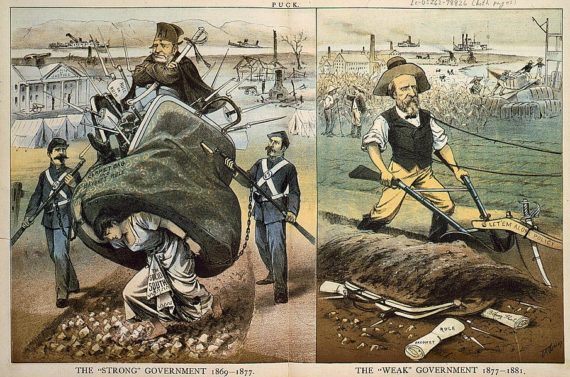

At this point you might be wondering why we have a currency system in which federal reserve notes are not “backed” by anything? The reason is that over time we have shifted our investment practices from saving money to purchase capital to a system of credit formation as the basis of investment. Let’s take a closer look at the two practices. In the former, which we might term “capitalism,” one saved or borrowed saved money to purchase land, labor, and capital to put to use in the production of goods and services, thereby increasing wealth. In a “credit” system, one borrows currency that did not previously exist until it was loaned to purchase land, labor, and capital to put to use in the production of goods and services. This transition from “capitalism” to what Richard Duncan refers to as “creditism” was long and complex, but it began in the late Middle Ages with the rise of goldsmiths in London (and elsewhere) who began to offer “banking” services, i e. storage services, for those wishing to have a place to keep their gold and silver, and also offered loans to merchants. When one stored their gold or silver with the goldsmiths, the person received a receipt, an IOU. Over time these IOUs came to be accepted as a medium for exchange, because they were as “good as gold.” The temptation to avarice being a part of the human condition, goldsmiths began to make loans with receipts that were not backed by physical gold. The goldsmiths could thus earn interest on these loans of currency which were not fully backed by money. Of course such a system increased their profits from lending, but it also carried great systemic ricks. The goldsmiths were confident that they would always have enough gold on hand to honor any receipts that were presented to them for redemption. Of course there were those occasions when the goldsmiths were wrong, and a “run on the bank” ensued. Angry receipt holders presented the goldsmith’s IOUs for payment in gold, only to find that the gold was gone—other receipt holders beat them to it.

The goldsmiths were not the only ones who engaged in fraudulent practices. Governments since ancient times devalued money through any number of practices. Recall, that gold and silver coinage were long the money and currency of ancient empires and medieval states. Governments regularly engaged in such practices as coin shaving and clipping, and/or debasement to fund the state—or line the pockets of government officials and their patrons and clients. In coin clipping or shaving one merely shaved off the outer rim of a silver or gold coin, reducing the precious metal content without adjusting the coin’s face value. Debasement was the practice of mixing a base metal with the precious metal without reducing the face value of the coin. A modern example of debasement was when President Lyndon Johnson removed the silver content from most American coins after 1964 and replaced the silver with zinc or nickel. The results were predictable. The value of the new coins plummeted as their purchasing power declined, and the old silver coins were hoarded. Thus Gresham’s Law was proved, the new “bad” money drove the “good” money out of circulation.

The question that is raised by outlining these fraudulent practices is cui bono? We will attempt to answer that question in our next installment.